Embark on a journey into the world of online stock trading with the best sites that offer low-cost portfolio management tools and US tax-efficient options. This comprehensive guide will navigate you through the intricacies of investing in stocks online, empowering you to make informed decisions for your financial future.

Overview of Online Stock Trading Platforms

Online stock trading refers to the process of buying and selling stocks through internet-based platforms. This method allows investors to trade stocks without the need for a traditional broker, providing a convenient and cost-effective way to manage their investment portfolios.

Key Features of Online Platforms for Buying Stocks:

- Access to Real-Time Market Data: Online platforms offer up-to-date information on stock prices, market trends, and news that can help investors make informed decisions.

- Trading Tools and Analysis: Many online platforms provide tools for technical and fundamental analysis, helping investors assess the performance of stocks and identify potential investment opportunities.

- Low Costs and Fees: Online stock trading platforms typically have lower fees and commissions compared to traditional brokers, making it more affordable for investors to buy and sell stocks.

- Diverse Investment Options: Investors can access a wide range of stocks, ETFs, mutual funds, and other investment products through online platforms, allowing for greater diversification of their portfolios.

Benefits of Using Online Platforms for Stock Trading:

- Convenience: Investors can trade stocks anytime, anywhere, using their computer or mobile device, without the need to visit a physical broker's office.

- Control and Flexibility: Online platforms give investors full control over their investment decisions, allowing them to execute trades quickly and customize their portfolios according to their preferences.

- Educational Resources: Many online platforms offer educational resources, tutorials, and research tools to help investors improve their knowledge and skills in stock trading.

- Tax Efficiency: Some online platforms provide tax-efficient investing options, such as tax-loss harvesting, to help investors minimize their tax liabilities and maximize their returns.

Importance of Low-Cost Portfolio Management Tools

When it comes to investing in the stock market, minimizing costs is crucial in maximizing returns. Low-cost portfolio management tools play a significant role in helping investors achieve this goal by reducing fees and expenses associated with managing their investments.

Examples of Low-Cost Portfolio Management Tools:

- Wealthfront: Wealthfront offers automated investment management services with low fees, charging an annual advisory fee of 0.25% of assets under management.

- Robinhood: Robinhood is a commission-free trading platform that allows investors to buy and sell stocks without paying any fees or commissions.

- Vanguard Personal Advisor Services: Vanguard offers a hybrid robo-advisor service with a flat annual fee of 0.30% on assets under management.

Comparison of Fees Associated with Different Tools:

- Wealthfront: Charges an annual advisory fee of 0.25% of assets under management.

- Robinhood: Offers commission-free trading, allowing investors to trade stocks without paying any fees.

- Vanguard Personal Advisor Services: Charges a flat annual fee of 0.30% on assets under management.

Impact of Low-Cost Tools on Investment Returns:

Low-cost portfolio management tools can have a significant impact on investment returns by reducing the drag of fees and expenses on the overall portfolio performance. By minimizing costs, investors can keep more of their investment gains, leading to higher returns over the long term.

Tax-Efficient Options for US Investors

When it comes to investing in the stock market, US investors need to consider tax implications to optimize their returns. Tax-efficient investing involves strategies and tools that help minimize the impact of taxes on investment gains.

Specific Tax-Efficient Options

- Utilizing tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k)s can help investors defer or avoid taxes on capital gains and dividends.

- Investing in tax-efficient funds such as index funds or exchange-traded funds (ETFs) can reduce taxable events and lower the overall tax burden.

- Harvesting tax losses by selling investments at a loss to offset capital gains and reduce taxable income for the year.

Importance of Considering Tax Implications

Choosing the right investment platforms that offer tax-efficient options can significantly impact the after-tax returns of investors. By minimizing taxes on investment gains, investors can keep more of their profits and grow their portfolios faster over time. It is essential to consider tax implications when making investment decisions to maximize overall returns.

Best Sites for Buying Stocks Online

When it comes to buying stocks online, there are several popular platforms that cater to both beginner and experienced investors. These platforms offer a range of features, fees, and user experiences that can make a significant difference in your investment journey.

1. Robinhood

- Commission-free trading for stocks, ETFs, options, and cryptocurrencies.

- User-friendly mobile app with a simple interface.

- Limited research tools compared to other platforms.

2. TD Ameritrade

- Wide range of investment options including stocks, ETFs, mutual funds, and more.

- Advanced trading platform for active traders.

- Higher fees compared to some other platforms.

3. E*TRADE

- Robust research tools and educational resources for investors.

- Access to a variety of investment products.

- Higher fees for certain transactions.

4. Fidelity

- Low-cost trades and a wide selection of commission-free ETFs.

- Excellent customer service and educational resources.

- Higher fees for broker-assisted trades.

Strategies for Building a Diversified Portfolio

Diversification is a crucial strategy in stock trading as it helps reduce risk by spreading investments across different asset classes, industries, and geographic regions. By diversifying your portfolio, you can potentially minimize losses that may occur if one particular investment performs poorly.

Importance of Diversification

Diversification is essential because it ensures that your portfolio is not overly reliant on the performance of a single stock or sector. By investing in a variety of assets, you can potentially offset losses in one area with gains in another, ultimately leading to a more stable and balanced portfolio.

Tips for Building a Diversified Portfolio

- Invest in a mix of asset classes such as stocks, bonds, and real estate investment trusts (REITs) to spread risk.

- Allocate your investments across different industries to avoid concentration risk.

- Consider investing in international stocks to diversify geographically and reduce exposure to any single market.

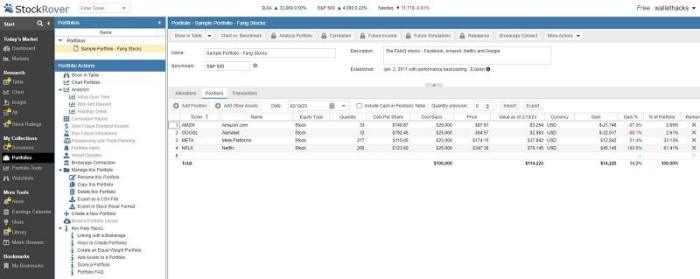

- Use online portfolio management tools to track and rebalance your portfolio regularly to maintain diversification.

Role of Asset Allocation

Asset allocation plays a critical role in portfolio management as it involves dividing your investments among different asset classes based on your risk tolerance, investment goals, and time horizon. By strategically allocating your assets, you can achieve the right balance of risk and return to meet your financial objectives.

Utilizing Research Tools and Analysis

Investors can maximize their potential for success in the stock market by utilizing the research tools available on online trading platforms. These tools provide valuable insights and data that can aid in making informed investment decisions.

Exploring Research Tools on Online Stock Trading Platforms

- Most online trading platforms offer a range of research tools such as stock screeners, financial reports, analyst ratings, and historical data.

- Investors can use stock screeners to filter stocks based on specific criteria such as market capitalization, P/E ratio, dividend yield, and more.

- Financial reports provide detailed information about a company's financial health, including revenue, earnings, debt levels, and cash flow.

- Analyst ratings offer insights from professional analysts on whether a stock is a buy, hold, or sell.

- Access to historical data allows investors to analyze a stock's performance over time and identify trends.

Using Research Tools for Analysis and Decision-Making

- Investors can use research tools to conduct fundamental analysis by evaluating a company's financials, management team, industry trends, and competitive position.

- Technical analysis involves analyzing stock price charts and patterns to predict future price movements.

- By combining both fundamental and technical analysis, investors can make well-informed decisions about buying or selling stocks.

Examples of How Research Tools Aid in Stock Selection

- For example, a stock screener can help an investor identify undervalued stocks with strong growth potential based on specific criteria like low P/E ratio and high earnings growth.

- Financial reports can reveal if a company is financially stable and has a history of consistent revenue and earnings growth, making it a promising investment opportunity.

- Analyst ratings can provide valuable insights into a stock's potential performance, helping investors make decisions aligned with expert opinions.

Final Conclusion

In conclusion, exploring the best sites for buying stocks online with low-cost portfolio management tools and US tax-efficient options opens up a realm of possibilities for investors. By leveraging these platforms and strategies, you can optimize your investment portfolio and pave the way for financial success.

Top FAQs

What are some examples of low-cost portfolio management tools?

Some examples include Robinhood, M1 Finance, and Betterment.

How do tax-efficient options benefit US investors?

Tax-efficient options help minimize tax liabilities, allowing investors to keep more of their returns.

Which online platform is known for its user experience and customer reviews?

Webull is recognized for its user-friendly interface and positive customer feedback.

![Choosing The Best Futures Trading Platform [2025 Guide] | Phidias Propfirm](https://share.kandisnews.com/wp-content/uploads/2025/12/5f7862f4f85e0c468300202204178ea7-120x86.jpg)